2025 Budget

The Northern Rockies Regional Municipality (NRRM) reviews and approves an annual budget that sets tax rates to fund essential community services.

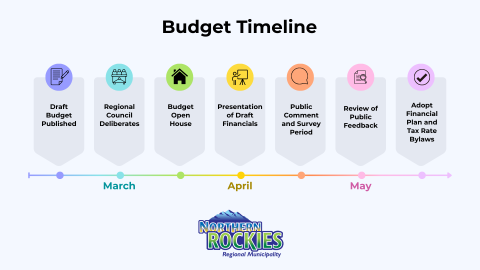

On April 30, 2025, Regional Council approved the 2025 municipal budget, following a review of public feedback and careful consideration of community priorities. Then, on May 6th, approval was given for the Five Year Financial Plan Bylaw No. 234 and Tax Rates Bylaw No. 235, reflecting continued service levels and targeted investments in key community needs.

Key Budget Facts

- Minimal Budget Increase: 2025 proposed Budget shows an increase of 2% over 2024 ($529,000) for municipal services, focused on maintaining service levels.

- Increase in Annual IDCA Funding: The Infrastructure Development Contribution Agreement Funding is provided by the Province annually as a matching contribution to cost of renewing municipal infrastructure. The NRRM will receive $6.69 million annually for the next 5 years.

- Wildfire Risk Mitigation: $500,000 project added through draft budget deliberations to reduce the risk of wildfire impacts to the community.

- Grants to Groups: The 2025 proposed Budget for community organizations holds budgets at the amounts levied in 2024, resulting in a total reduction of $60,000 between the amounts requested and the amount included in the budget.

- Impact of the Budget to Taxpayers: Each $100,000 in the budget amounts to a +/- of $1.83 per $100,000 of assessed value (on a residential tax bill).

- Allowance for Uncollectible Taxes: There is a $2.5M allowance in the budget based on estimated risk of being unable to collect unpaid industrial property taxes for values on Crown leases.

Image

Draft Budget Meeting Videos:

Helpful Resources: Taxation and Budget 101